Part A: Unaudited information

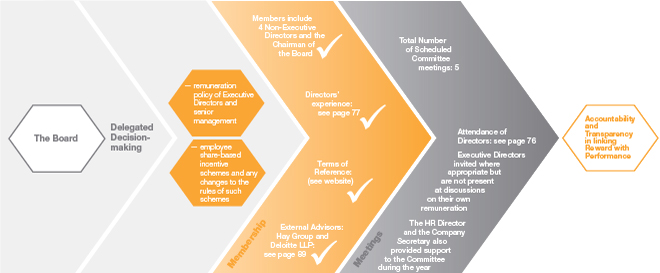

Committee Leadership — Decision-Making — Delegated by the Board

Remuneration Policy

The remuneration policy of the Committee and of the Board is to provide remuneration packages for Executive Directors and other senior managers in the Group which:

- Align management's interests with those of shareholders by incentivising management to deliver the Group's long-term strategy and enhance shareholder value.

- Provide management with the opportunity to earn competitive remuneration through variable-based pay.

- Provide upper quartile rewards compared to other general retail companies of a similar size, but only if above upper quartile performance is delivered.

- Enable the Group to attract and retain management of the calibre required to run the business and drive exceptional shareholder value creation.

The Board reviews this policy and whether remuneration arrangements appropriately reflect this policy annually.

During the year and the period to the date of this report the Remuneration Committee, supported by Deloitte LLP:

- Considered the Group's remuneration policy.

- The Committee considered the broad policy continued to be aligned with the strategy and long-term success of the business.

- The Committee considered whether the remuneration arrangements, including variable, performance-based elements, continue to be structured to ensure associated performance remains aligned with the strategic objectives of the Company and incentivises managers.

- Consideration was given to the appropriateness of the performance conditions of the Company's Performance Share Plan. The Committee considers that the performance measures that applied to the 2011–14 scheme continue to be appropriate for the business and therefore these measures will also apply for the 2012–15 scheme. During the year the Committee assessed TSR and EPS performance for the 2009–2012 scheme. These targets were not meet and therefore this award will not vest.

- The 2011/12 bonus was based 80% on Profits Before Tax ("PBT") and 20% on Earnings Per Share ("EPS") performance. During the year neither the PBT or the EPS targets were met and therefore no bonus will be paid to Executive Directors in respect of 2011/12 performance.

- Consideration was given to the targets for the Executive Directors' and senior managers' short-term bonus arrangements for 2012/13. The Committee considered that the target range previously used was too narrow in the context of expected performance for 2012/13 and therefore determined that a range of 92% (zero payout) to 106% (full payout) was more appropriate.

- The Committee also considered the measures used for the bonus and agreed that the 80% PBT, 20% EPS arrangements would be replaced, with future payments being based 75% on PBT and 25% on a number of key non-financial metrics linked to the strategy and operation of the business. These metrics have been selected in order to support the enhancement of strategic pillars which the Committee ultimately believes will lead to the creation of shareholder value.

- When determining bonus payouts for 2012/13, in addition to considering performance against targets, the Committee will also consider the underlying performance of the business and performance against strategic initiatives. It retains the discretionary authority to increase or decrease the bonus to ensure that the level of bonus paid is appropriate in the context of performance and value delivered for shareholders. Discretion shall in all cases only be exercised within the agreed boundaries and maxima.

- The Committee also considered whether it would be appropriate to disclose a single figure for the total of each Director's remuneration. It was decided that at this time, that as there was no agreed basis for calculation of this figure, that any disclosure could be misleading. We will, however, keep this under review as regulations and market practice develop.

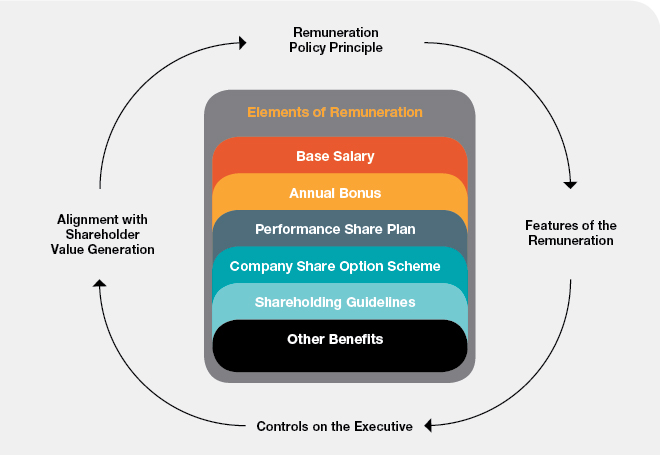

Executive Directors' Remuneration — the Elements

The following sections illustrate how each individual element of remuneration is specifically designed to support the achievement of different corporate objectives.

| Base Salary

(see also Note 1) | Annual Bonus | Performance Share Plan ("PSP")

(see also Note 2) | Company Share Option Scheme ("CSOS") | Shareholding Guidelines

(see also Note 3) | Other Benefits

(see also Note 4) |

| Remuneration Policy Principle |

Set to be market competitive against other retail companies of a similar size for comparable roles. |

Reward the achievement of annual earnings targets and performance against key strategic goals. |

Align Executives' and shareholders' interests and reward growth in shareholder value and earnings. |

Direct link to value creation through share price growth as major objective. |

Align Directors' interests with shareholder interests. |

Market median competitive remuneration. |

| Features of the Remuneration |

Paid monthly in cash. |

CEO – maximum award 150% base salary – 2/3 in cash with 1/3 deferred in shares for three years.

Finance and Commercial Directors – 100% base salary – full bonus in cash.

Bonuses are non-pensionable. |

Maximum core award 150% base salary.

Performance multiplier of 1.5 × core award for exceptional performance (upper decile).

Vests over a three-year performance period. |

As the Executive Directors primarily participate in the PSP, it is currently intended that no further awards are made to them under the Company Share Option Scheme. |

Executive Directors are required to acquire and retain shares. |

Pension contribution of 15% of base salary

Company car or equivalent allowance

Permanent Health Insurance

Life Assurance Cover

Membership of a Private Medical Insurance Scheme

Travelling and other expenses |

| Controls on the Executive |

Annual reviews (subject to any material changes in responsibilities) of requisite experience, responsibilities, performance, commitment, and efficiency alongside contribution to corporate. |

Targets are calibrated to ensure that they are very stretching and demanding, with the maximum bonus only being achievable for exceptional performance. For FY13 75% of the annual bonus is dependent upon Profit Before Tax ("PBT") and 25% on a number of key non-financial metrics linked to the strategy and operation of the business. |

50% determined by the Group's relative TSR performance measured against a general retailers comparator group chosen from the FTSE 350 and the balance of 50% determined by the Group's absolute EPS growth performance. |

In the event that awards are made under the CSOS to Executive Directors, the Committee would review the performance measures and set targets which are suitably stretching. |

Shareholding must be to a value equal to 100% of their base annual salary and Executive Directors have a five-year period to build this shareholding following their appointment. |

|

| Alignment with Shareholder Value Generation |

High calibre and performing Executives are and continue to be in place to manage the Company. Current salaries are set at a competitive level to retain Executives. |

Executives are incentivised to deliver annual performance with the CEO further incentivised to manage risk and align his long-term interests with those of shareholders. |

Challenging and appropriately stretching targets.

Award delivered in shares to align Executives with share price movement. |

Challenging and appropriately stretching targets.

Award delivered in shares to align senior Executives with share price movement. |

As long-term shareholders themselves, Executives are incentivised to consider the interests of shareholders and shareholder value creation. |

|

|

|

|

|

|

|

|

Note 1

In October 2011, a Group-wide salary review was undertaken which took into account remuneration trends, candidate quality and job location in markets in which the Group had recently recruited. With respect to the Executives, the salary review also considered executive remuneration market trends and benchmarking. The salary increases from 1 April 2012 recommended by the Committee, and approved by the Board, are detailed below alongside the average percentage increase awarded across the Group. The Committee was mindful to ensure that no Director received an increase in excess of the average across the Group of 2%. The Chief Executive received 2%, an increase to £517,650, the Finance Director also received 2%, an increase to £280,500. The Commercial Director's salary remained at £290,700.

Note 2

Under the PSP, conditional rights to receive shares or nil cost options over shares are awarded to participants. PSP Awards have been made in every year since 2005.

Note 3

The beneficial interests of Directors, serving at the end of the period, in shares in Halfords Group plc are shown opposite.

The figures include those of their spouses, civil partners and infant children, or stepchildren, as required by Section 822 of the Companies Act 2006.

| Fully paid Ordinary Shares of 1p each |

| As at

30 March 2012 | As at

1 April 2011 |

| Dennis Millard |

32,500 |

32,500 |

| David Wild |

260,464 |

100,000 |

| Paul McClenaghan |

146,221 |

124,744 |

| Andrew Findlay |

2,850 |

— |

| Keith Harris |

3,846 |

3,846 |

| Bill Ronald |

11,538 |

11,538 |

| David Adams |

— |

— |

| Claudia Arney |

— |

— |

There were no changes in the beneficial interests of the Directors in the Company's shares between 30 March 2012 and 31 May 2012.

Note 4

During 2008/9 the Company changed its pension arrangements to prepare for the Government's introduction of Personal Accounts. The Halfords Pension Plan moved from a defined contribution scheme to a contract-based plan, where each member has their own individual pension policy which they monitor independently. For each member could also benefit from salary sacrifice arrangements. Both schemes were open to the Executive Directors, who each receive a pension contribution of 15% of base salary per annum. The Group's contributions during the year are shown in the Pension Entitlements table.

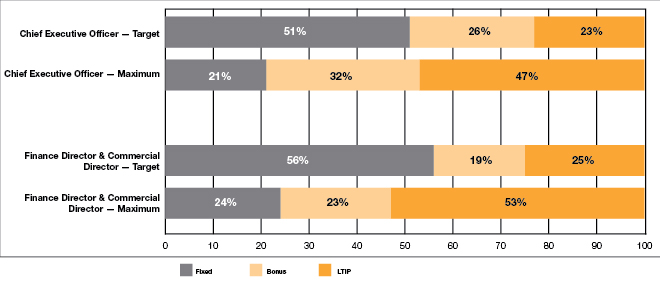

Striking a Balance between Fixed and Variable Remuneration

As outlined above, the remuneration policy is designed to ensure that a substantial proportion of the Executive Directors' remuneration is variable and performance-related. By linking the remuneration of the individual Executive Director to the performance of the Company, the Board seeks, as far as possible, to motivate that individual towards superior business performance and shareholder value creation, and to only pay rewards when these goals have been realised. Performance measures are aligned with strategic goals so that remuneration arrangements are transparent to Directors, shareholders and other stakeholders.

The chart above seeks to illustrate the overall balance between fixed and variable remuneration within the current remuneration policy.

Executive Directors' Service Agreements

Term

The Company's policy in relation to contractual terms on termination, and any payments made, is that they should be fair to the individual, the Company and shareholders. Failure should not be rewarded and the departing Executive's duty to mitigate loss should be fully recognised. The Committee periodically reviews the Group's policy on the duration of Directors' service agreements, and the notice periods and termination provisions contained in those agreements. Whilst the Company is aware that companies are encouraged to consider notice periods of less than 12 months, the Committee believes that the current policy, whereby notice periods contained in Executive Directors' service contracts should be limited to 12 months (other than in exceptional circumstances, such as for the purposes of recruitment), is more in line with the Company's overall remuneration policy that is designed to attract and retain high calibre Executives.

| Date of Service

Agreement | Notice

Period |

| David Wild |

19 June 2008 |

12 months |

| Andrew Findlay(1) |

16 November 2010 |

12 months |

| Paul McClenaghan |

9 May 2005 |

12 months |

- Andrew Findlay was appointed to the Board on 1 February 2011 and his service agreement was effective from that date.

Early Termination

No compensation would be payable if a service contract were to be terminated by notice from an Executive Director or for lawful early termination by the Company.

The Company may terminate any of the above service agreements by giving not less than 12 months' notice. In the event of early termination (other than for a reason justifying summary termination in accordance with the terms of the service agreement) the Company may (but is not obliged to) pay to the Executive Director, in lieu of notice, a sum equal to the annual value of the Executive Director's then salary, benefits, pension contributions and on-target bonus (calculated on a pro rata daily basis) which he would have received during the contractual notice period, the sum of which shall be payable in 12 monthly instalments.

Mitigation in Termination

In such instances the Executive Director shall use their best endeavours to secure an alternative source of remuneration, thus mitigating any loss to the Company, via the provision of his services as expediently as possible in the prevailing circumstances and shall provide the Board with evidence of such endeavours upon their reasonable request. If the Director fails to provide such evidence the Board may cease all further payments of compensation. To the extent that the Executive Director receives any sums as a result of alternative employment or provision of services while he is receiving such payments from the Company, the payments shall be reduced by the amount of such sums.

Change of Control

The service agreements of Executive Directors do not provide for any enhanced payments in the event of a change of control of the Company.

External Directorships

The Group is supportive of Executive Directors who wish to take on a non-executive directorship with a publicly quoted company in order to broaden their experience and they are entitled to retain any fees they may receive. David Wild was appointed as a Non-Executive Director of Premier Foods on 7 March 2011 and in the period ended 30 March 2012 he received £57,000 in fees (7 March to 1 April 2011: £4,750).

Remuneration for Senior Managers

As for Executive Directors, it is the Company's policy that a substantial proportion of remuneration should be performance related in order to encourage and reward superior business performance and shareholder returns and that remuneration should be linked to both individual and Company performance. Basic salary is targeted at normal commercial rates for comparable roles and is benchmarked on a regular basis. Bonuses of up to 100% of salary can be earned on the same basis as the Executive Directors.

Senior Executives immediately below the Board also benefit from participation in the PSP, with other key senior managers participating in the CSOS.

Share Plans — Summary

While committed to the use of equity-based performance-related remuneration as a means of aligning Directors' interests with those of shareholders, the Committee is aware of shareholders' concerns on dilution through the issue of new shares to satisfy such awards. Therefore, when reviewing remuneration arrangements, the Committee takes into account the effects such arrangements may have on dilution. Halfords intends to comply with the ABI guidelines relating to the issue of new shares for equity incentive plans. The current 10 year shareholder dilution is 2.60% [2011: 4.31%].

| Date of Adoption | Eligibility | More information |

| Halfords Company Share Option Scheme ("CSOS") |

May 2004 |

Used to reward employees below the Board and it is not the current intention to grant awards under the CSOS to Executive Directors (other than in exceptional circumstances). |

The CSOS is a market value option plan which incentivises senior management to grow the share price. Options are granted at an exercise price not less than market value at the date of grant and are normally subject to performance. Currently, vesting of options is subject to an earnings per share hurdle. |

| Halfords Sharesave Scheme |

May 2004 |

An all-employee SAYE scheme in which all Executive Directors are eligible to participate. |

During the year the Committee considered the principles behind the establishment of the SAYE scheme in 2011 and concluded that the current scheme remains appropriate. Options are granted at an exercise price not less than 80% of market value at the date of grant. Options may not normally be exercised until the option holder has completed his or her savings contract (normally three or five years) from the date of commencement of the savings contract. Executive Directors may also join the Halfords Sharesave Scheme. During the year awards were granted under the SAYE to participating eligible employees in the United Kingdom, Ireland and Hong Kong. |

| Performance Share Plan ("PSP") |

July 2005 |

Main incentive vehicle for Executive Directors and senior managers immediately below the Board with awards generally made on an annual basis. |

See Note 1 below. |

Note 1

The PSP targets are summarised in the table below:

For the core award, 30% of the award vests for achieving median TSR performance compared to the comparator group described below and EPS growth of RPI plus 4% per annum. The full core award vests for achieving upper quartile TSR and EPS growth of RPI plus 11% per annum. For the award multiplier, the TSR element will only vest if TSR performance is between upper quartile and upper decile. For the EPS element the multiplier will only apply if EPS growth exceeds RPI plus 11% per annum, with the maximum multiplier only being achieved if EPS growth equals RPI plus 16% per annum. For the core award and the multiplier straight-line vesting applies between each of these points.

|

|

TSR Performance Element

(50% of award) | EPS Performance Element

(50% of award) |

Award "Multiplier"

(up to 1.5 × initial award)

i.e. 225% of salary |

1.5 × initial award vesting |

Upper Decile performance |

16% growth p.a. above RPI |

| Straight-line vesting |

Between Upper Quartile and Upper Decile |

Between 11% growth p.a. and 16% growth p.a. above RPI |

| Core Award(150% of salary) |

100% vesting |

Upper Quartile performance |

11% growth p.a. above RPI |

| Straight-line vesting |

Between Median and

Upper Quartile |

Between 4% growth p.a. and 11% growth p.a. above RPI |

| 30% vesting |

Median |

4% growth p.a. above RPI |

| 0% vesting |

Below Median |

Below 4% growth p.a. above RPI |

TSR and EPS performance will be assessed on an independent basis. However, to ensure that the PSP continues to support sustainable performance, the multiplier for one measure will only be applied if performance is at least at the threshold level for the other measure. For example, if TSR was above upper quartile the TSR multiplier would generally only apply if EPS growth exceeded RPI plus 4% per annum, unless the Remuneration Committee determined otherwise.

The companies included in the TSR comparator group for awards granted in 2011 are as follows:

- Brown Group

- Greggs

- Mothercare

- Carpetright

- Home Retail Group

- Next

- Debenhams

- JD Sports Fashion Plc

- Sainsbury's

- Dignity

- Kesa Electrics

- Sports Direct International

- Dixons Retail plc

- Kingfisher

- Dunelm Group

- Marks & Spencer

- Tesco

- Morrisons

- WH Smith

The comparator group for awards pre-2010 (which did not include the performance multiplier) was similar to the above group but did not include food retailers.

The Committee believes that the operation of the PSP is appropriate to continue to effectively incentivise and retain key Executives in a way which is aligned with our long-term strategy and the creation of shareholder value. The Committee recognises that a plan that incentivises higher levels of performance involves a larger degree of inherent risk; however, the Committee believes that the Board decision-making process provides appropriate safeguards to ensure that this structure does not incentivise Executives to take an inappropriate level of risk.

For 2009 awards onwards, the Committee also recommended the reinvestment of dividends earned on award shares. This is in line with best practice as contained in the ABI guidelines on executive remuneration.

In 2008 and 2009 (the first two years of his tenure) the Chief Executive received awards under the PSP of 200% of base salary; these awards are not subject to the performance multiplier. On the vesting of any of this award David Wild was encouraged to retain shares, so enabling him to achieve the shareholding guidelines.

Following his appointment, Andrew Findlay was granted a PSP award of 225% of salary in August 2011. This award was subject to the performance conditions outlined within this report. If exceptional performance is delivered then up to 1.5× this award may vest. The Committee considered that it was appropriate to grant this enhanced award to Mr Findlay to compensate him for awards he forfeited on leaving his previous employment.

Details of awards granted to Executive Directors in the Performance Share Plan.

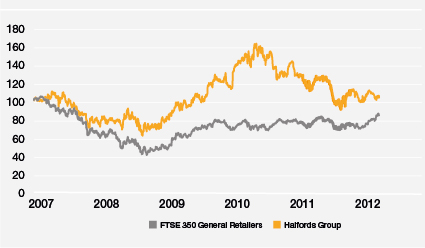

Performance graph

The following graph shows the TSR performance of the Company since April 2007, against the FTSE 350 General Retailers (which was chosen because it represents a broad equity market index of which the Company is a constituent).

TSR was calculated by reference to the growth in share price, as adjusted for reinvested dividends.

Cumulative TSR Based to 100

Non-Executive Directors' Remuneration

The Board as a whole, following a recommendation by the Chief Executive, determines the fees of the Non-Executive Directors.

Term

None of the Non-Executive Directors has an employment contract with the Company. However, each has entered into a letter of appointment with the Company confirming their appointment for a period of three years, unless terminated by either party giving the other not less than three months' notice or by the Company on payment of fees in lieu of notice.

Continuation

The appointments are subject to the provisions of the Companies Act 1985 and 2006 and the Company's Articles of Association and in particular the need for periodic re-election. Continuation of an individual Non-Executive Director's appointment is also contingent on that Non-Executive Director's satisfactory performance, which is evaluated annually.

Compensation for Termination

No compensation would be payable to a Non-Executive Director if his or her engagement were terminated as a result of him or her retiring by rotation at an Annual General Meeting, not being elected or re-elected at an Annual General Meeting or otherwise ceasing to hold office under the provisions of the Articles of Association of the Company.

There are no provisions for compensation being payable upon early termination of the appointment of a Non-Executive Director.

Fees

During the year fees for the Chairman and Non-Executive Directors were reviewed and it was agreed that there would be no increases. Halfords' policy in relation to Non-Executive Director fees is as follows:

| Role | Fees |

| Chairman |

£165,000 |

| Senior Independent Director |

£60,000 |

| Basic Fee |

£45,000 |

| Additional fee for Chairmanship of the Audit and Remuneration Committee |

£5,000 |

The Chairman and the other Non-Executive Directors are not eligible to participate in the Company's bonus arrangements, share incentive plans or pension arrangements.

Appointment Periods

| Date of

appointment | Date of

current

reappointment | Date of resignation | Expiry date | Unexpired term at

the date of

this report |

| Dennis Millard |

28 May 2009 |

29 May 2012 |

— |

29 May 2015 |

36 months |

| David Adams |

1 March 2011 |

2 August 2011 |

— |

28 February 2014 |

21 months |

| Claudia Arney |

25 January 2011 |

2 August 2011 |

— |

24 January 2014 |

20 months |

| Keith Harris |

17 May 2004 |

2 August 2011 |

— |

26 July 2013 |

14 months |

| Bill Ronald |

17 May 2004 |

2 August 2011 |

— |

26 July 2013 |

14 months |

The terms and conditions and letters of appointment are available on the Company's Corporate and IR website.

Advisors

Hay Group — During the year continued to provide advice on matters relating to remuneration, including market comparison data and best practice. No other services are provided to the Group

Deloitte LLP — During the year continued to advise on share-based long-term incentive plans and other remuneration matters. Deloitte also provide unrelated advisory and tax services to the Group.

The Committee continues to be satisfied that the advice received from its advisors is independent.