Corporate Governance Report

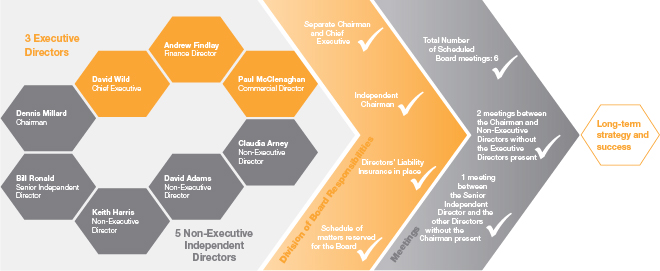

"As Chairman, I aim to guide my colleagues on the Board to deliver effective and accountable leadership for the benefit of our shareholders, the Company and other stakeholders. My colleagues on the Board and I take seriously our collective responsibility for the long-term direction and strategy of the Group. We are convinced that a strong framework of corporate governance practices contributes to the success and future of our business strategy and processes. In the following pages of this Corporate Governance Report, we seek to illustrate how we have applied the UK Corporate Governance Code through the use of committees and delegated decision-making, supported by risk management and accountability controls, to provide effective leadership to the business."

Dennis Millard

Chairman

Statement of Compliance with the UK Corporate Governance Code

For the period ended 30 March 2012, the Board considers that the Group has complied fully with the UK Corporate Governance Code 2010 (“the Code”). The Code is published by the Financial Reporting Council from whom paper and downloadable versions can be obtained via its website: www.frc.org.uk. We have outlined in this report how we have complied with the five main principles of the Code using the same headings as the main sections of the Code.

| The Board of the Company |

| Designation | Date of Original

Appointment | Date of Most Recent

Re-election |

| Dennis Millard |

Chairman |

28 May 2009 |

28 May 2012 |

| David Wild |

Chief Executive |

4 August 2008 |

2 August 2011 |

| Paul McClenaghan |

Commercial Director |

31 March 2007 |

2 August 2011 |

| Andrew Findlay |

Finance Director |

1 February 2011 |

2 August 2011 |

| Claudia Arney |

Non-Executive Director |

25 January 2011 |

2 August 2011 |

| David Adams |

Non-Executive Director |

1 March 2011 |

2 August 2011 |

| Keith Harris |

Non-Executive Director |

17 May 2004 |

2 August 2011 |

| Bill Ronald |

Senior Independent Director |

17 May 2004 |

2 August 2011 |

N.B. All Directors will submit themselves for re-election at the 2012 AGM.

Effective Accountable Leadership

Leadership — How the Board Operates — Effective Meetings

During the year the Chairman, supported by the Company Secretary, continued the practice of maintaining a rolling 12-month agenda for Board and Committee meetings. Agenda items included standing items such as progress reports from the Executive Directors and the Company Secretary, as well as periodic items such as: updates from Committee Chairs, a review of the risk register and internal controls, strategy, and succession planning. The annual agenda also establishes the time frame for finalisation and circulation of the pre-meeting papers. This ensures that the Directors receive the complete information, sufficiently in advance of the meeting, such that the Board can make effective decisions within the meeting itself. In this manner, the Chairman and the Board can have confidence that the yearly cycle of meetings allows sufficient time for discussion by the Board of each matter, at the most appropriate meeting in the year, enabling them to discharge their duties as Directors effectively. Additional meetings were also held throughout the year when business needs arise.

Time Spent on Board Business

| Reserved Matter | Key Considerations throughout the Period |

| Authority |

Reports from the Audit, Remuneration and Nomination Committees on their activities. Company Secretary's Report. Board Evaluation. |

| Strategy and Management |

Reviewing long-term vision, financial performance, investment and people initiatives, actual figures against forecast and commercial initiatives. Reports from the Chief Executive, Finance and Commercial Director. Group Budget. Store Refresh programme. Group Strategy. |

| Structure & Capital |

Share buyback programme. Liabilities of the Company. |

| Investor Relations |

Discussions with brokers. Shareholder analysis and feedback. |

| Audit. Financial Reporting & Controls |

Consideration and approval of: Pre-Close announcement, Final and interim dividend approvals. Risk Register review. Approval of the Annual Report and Accounts. Final results announcement. |

| Other Business |

Bribery and CR policies. Customer insight. Coventry distribution centre priorities. NED feedback from store visits. Tax & Treasury update. Governance and policies. HR reports. Car Maintenance and Cycle category plans. Updates on the Autocentres business. |

Leadership — How the Board Operates — Decision-Making

The Board is mindful of its duties and responsibilities to shareholders, customers, employees and other stakeholders in determining the long-term strategy and objectives of the Group. Such duties and responsibilities encompass: monitoring the achievement of business objectives and management performance; scrutinising the proposed contractual relationships of the Group; and safeguarding relationships with, and generating value for, shareholders; within the context of a sound and robust framework of internal controls and risk management. Therefore, specific matters which significantly impact on these areas of the business are reserved for the decision of the Board.

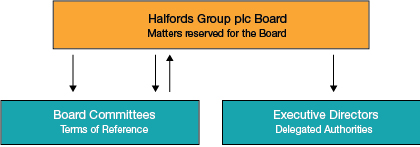

The Board recognises that for productive decision-making at Board meetings, as well as within the Group, certain decisions should be considered and made by the Board alone, whilst for other matters it is appropriate to delegate the Board's decision-making authority to its Committees or management. These arrangements are formally recorded in a Matters Reserved for the Board document which is reviewed and updated by the Board annually.

Reserved Matters — for the Board

Decisions specifically reserved for approval by the Board include those concerning the bounds of its authority, the strategy and business plan of the Group, any changes to the Group's capital structure, significant corporate transactions and assessments of the Group's risk and control processes.

Delegated Matters — to Board Committees

The responsibilities of the Board Committees are set out in the individual Terms of Reference of each Committee which comply with the Code. The contents of these are discussed further within the sub-sections that follow on the Committees and are also available on the Company's website.

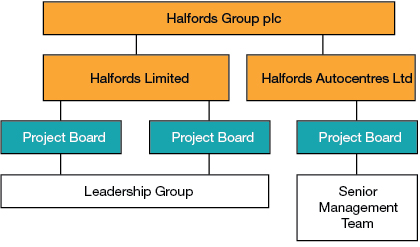

Delegated Matters — to Executive Directors

The Executive Directors further delegate their responsibilities, via the Group's Management Structure illustrated below, in line with a supporting document: Delegated Authorities. Each Executive Director and the Company Secretary has overall responsibility via this document for the relevant business function. The procedures for approving processes within these functions are clearly outlined establishing how and by whom approval of a business decision can be made and the required evidence of such approval. Examples of decisions delegated in this way are the placement of orders with suppliers, the entering into a contract with a web design agency, the appointment of professional health & safety advisors and the agreement of new portfolio deals.

The diagram below illustrates the management structure within the business.

The diagram below summarises how the Board exercises control over the activities of the business whilst delegating its decision-making authority to the Board Committees or the Executive Directors.

The Matters Reserved for the Board, Terms of Reference and Delegated Authorities documents combine to create a clear authority matrix across the Group for timely and effective decision-making. Matters are either:

| Evidenced by |

| Specifically Reserved for the Board; |

Matters Reserved for the Board |

Delegated to a Committee for recommendation, with final

approval given by the Board; |

Matters Reserved for the Board Committee Terms of Reference |

| Delegated to a Committee; or |

Matters Reserved for the Board Committee Terms of Reference |

| Delegated to Management. |

Matters Reserved for the Board Delegated Authorities |

Leadership — How the Board Operates — Non-Executive Directors

The Non-Executive Directors help the Executive Directors by contributing independent challenge and rigour to the Board's deliberations and assisting in the development of the Company's strategy. In addition, they are responsible for monitoring the performance of the Executive Directors against agreed goals and objectives. Their views are essential in the reporting of performance and in the integrity of the financial information, controls and risk management processes of the Company. In order to carry out these functions appropriately the Non-Executive Directors meet regularly with senior management and make periodic site visits and also meet separately without the Executive Directors present. Senior managers are also regularly invited to Board meetings to make business presentations to the Board.

Leadership — How the Board Operates — Senior Independent Director

Bill Ronald is the Senior Independent Director of the Company and as such works alongside the Chairman and is available to serve as an intermediary for the other Directors if necessary. He is also available to shareholders if direct contact with the Chairman, Chief Executive or other Executive Directors has failed to resolve the concerns of shareholders or for which such contact is inappropriate. As Senior Independent Director he also led the annual review of the performance of the Chairman.

In addition, should a Director have a concern over any unresolved business he/she is entitled to require the Company Secretary to minute the concern. Should the Director later resign over the issue, the Chairman will bring it to the attention of the Board.

Leadership — Board and Committees

During the year the Board scheduled eight meetings and the Nomination, Audit and Remuneration Committee four, three and five meetings respectively.

Board and Committee Meeting Attendance by the Directors

| Group

Board

8 | Nomination

4 | Audit

3 | Remuneration

5 |

| Dennis Millard |

8 |

4 |

3* |

5 |

| David Wild |

8 |

4 |

2* |

4* |

| Paul McClenaghan |

8 |

n/a |

1* |

n/a |

| Andrew Findlay |

8 |

n/a |

3* |

1* |

| Claudia Arney |

7 |

3 |

3 |

4 |

| David Adams |

7 |

4 |

2 |

5 |

| Keith Harris |

8 |

4 |

3 |

5 |

| Bill Ronald |

8 |

4 |

3 |

5 |

* attendance by invitation

Effectiveness — Board Composition

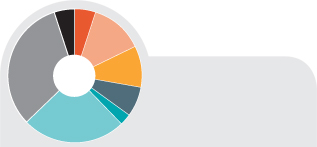

Throughout the period covered by this report, the Board comprised three Executive Directors, the Chairman and four independent Non-Executive Directors who bring to the Board the following key skills, experience, independence and knowledge:

| Key | Skills | Experience |

|

Leadership |

Retail |

Digital |

Strategy |

Finance |

Supply Chain |

Governance |

Banking |

Marketing |

Business Development/Brand Building |

Corporate |

Cross-Functional |

The Board considers that it has the right combination of skills, experience, independence and knowledge to be useful and effective in meeting the needs of the business. More than half of the Board are independent Non-Executive Directors. Dennis Millard was appointed Chairman on 28 May 2009 and reappointed on 28 May 2011. At the time of his appointment he was considered to meet the independence criteria. The other Non-Executive Directors are considered by the Board to be independent in character and judgement.

This combination of individuals and skills ensures that the Board is sufficiently balanced such that no individual or group of individuals can dominate decision-making and allows for an effective division of responsibilities within the Board and its Committees. The positions of Chairman and Chief Executive are held separately. The boundaries of their remit for running the Board and the business respectively are available on the Company's Corporate and IR website. Each Director devotes sufficient time and attention as is necessary in order to perform their duties.

Diversity

The Board considers itself diverse in terms of the background and experience each individual member brings to the Board. To maintain this, the considerations to be taken into account in each appointment to the Board are stipulated in the Terms of Reference of the Nomination Committee which are available on the Company's Corporate and IR website. Specifically, the Nomination Committee must "consider candidates on merit and against objective criteria, and with due regard for the benefits of diversity on the Board, including gender" in identifying and recommending candidates.

Currently one member of the Board is female. This appointment was made on the basis that Claudia Arney was the best-qualified candidate to provide the Board with the necessary support and expertise in developing the Group's online consumer and media strategy.

The Company is not generally in favour of setting a fixed quota of women on the Board. The Nomination Committee will continue to recommend appointments to the Board based on the existing balance of skills, knowledge and experience on the Board, on the merit and capabilities of the nominee and on the time they are able to devote to the role in order to promote the success of the Company.

Induction and Ongoing Training

Although no new appointments have been made in the year under review, an induction programme is maintained for new Directors, which is tailored to include briefings on the activities of the Group and visits to operational sites. All Directors are members of the Deloitte Academy, a training resource that provides support and guidance to boards and individual directors. Directors are informed of relevant material changes to laws and regulations affecting the Group's business and their duties as Directors. The Company Secretary advises the Board on governance matters and is available to all Directors for advice as required. All Non-Executive Directors have embarked on a series of head office and store visits through the year and feedback is provided at Board meetings.

Effectiveness — Board Committees

The Board has established a number of Committees to assist in the discharge of its responsibilities. The Company Secretary acts as secretary to the Committees.

Only the members of each Committee are entitled to attend its meetings, although other Directors, professional advisors and members of the senior management team attend when invited to do so. The Audit Committee will invite the Auditors to certain of its meetings. In the cases of the Nomination and Remuneration Committees, no member is present when business pertinent to them is under discussion. A Treasury Committee, composed of senior members of the finance and treasury teams and chaired by the Finance Director, has been established to manage the day-to-day treasury needs of the Group. A Disclosure Committee composed of a minimum of two Directors has been established to approve finalised market announcements prior to release.

When the need arises, separate ad hoc committees may be set up by the Board to consider specific issues.

Effectiveness — Directors and their Other Interests

Each Director has notified the Company of any situation in which he or she has, or can have a direct or indirect interest that conflicts, or possibly may conflict, with the interests of the Company (a situational conflict). These interests were considered and approved by the Board in accordance with the Company's Articles of Association and each Director was informed of the authorisation and the terms on which it was given. All Directors are aware of the need to consult with the Company Secretary regarding any further possible situational conflict that may arise so that prior consideration can be given by the Board as to whether or not such conflict will be approved.

Details of the Directors' service contracts, emoluments, the interests of the Directors and their immediate families in the share capital of the Company and options to subscribe for shares in the Company are shown in the Directors' Remuneration Report.

Effectiveness — Board Evaluation

In May 2011, the Board undertook an internal evaluation process via: one-to-one meetings between the Chairman and the other Directors, one-to-one meetings between the Senior Independent Director and the other Directors regarding the performance of the Chairman, and Board and Committee Evaluation Questionnaires. The collated information was reviewed by the Board and the appropriate Committee, and overall it was concluded that the performance of the Board as a whole, its principal Committees and individual Directors was such that each Director performs at the optimum level for the benefit of the Company. Following this review and in line with the Code, the Board committed to an external evaluation for the period.

The Board engaged Egon Zehnder in April 2011 to facilitate the external evaluation of the Board via a series of one-to-one interviews with each individual Director. Discussions included: the workings of the Board and its Committees; the balance of skills, expertise and personalities on the Board; and the need to consider the Board's composition in light of the Company's strategy of Friend of the Motorist, Best Cycle Shop in Town and the Starting Point for Great Getaways. Egon Zehnder are expected to report back to the Board on their findings in June 2012.

Effectiveness — Re-election

All Directors on the Board on 30 March 2012 will seek re-election at the Company's AGM on 31 July 2012 in compliance with the Code and the Company's Articles of Association.

Effectiveness — Nomination Committee

Chairman

Dennis Millard

Members

Dennis Millard (Committee Chairman)

David Adams

Keith Harris

Bill Ronald

Claudia Arney

David Wild

Meetings

Total Number of Committee meetings: 4

Terms of Reference:

Yes (see website)

"The Nomination Committee is pleased that the new Board members and senior Executives in whose appointment we were involved last year have established themselves well in, and are providing the fresh insight we anticipated. The Nomination Committee continues to take an active involvement in succession planning this year with the appointment of a number of senior Executives to further boost and complement the skills and experience brought by the Board and senior Executives."

Time Spent on Nomination Committee Business

| Delegated Remit —recommendations to the Board or for approval by the Committee | Key Considerations throughout the Period |

| Terms of Reference |

Appropriateness for an efficient and effective Nomination Committee. |

| Composition of the Board and Committees, and the appointment of the Senior Independent Director |

Board diversity. |

| Succession plans for the Board and senior management |

Executive management team composition, strengths, weaknesses. |

With the exception of David Wild, all members of the Committee are considered to be independent Non-Executive Directors. The Code states that the test of independence is not appropriate in relation to the Chairman after his appointment and the Board feels it is appropriate, as all Non-Executive Directors sit on the Committee, that the Committee should be chaired by the Chairman of the Group. Senior members of management and advisors are invited to attend meetings as appropriate.

The Committee has responsibility for considering the size, structure and composition of the Board of the Company, for reviewing senior management succession plans, retirements and appointments of additional and replacement Directors and making appropriate recommendations so as to maintain an appropriate balance of skills and experience on the Board.

The Nomination Committee has established a process for Board appointments that it considers to be formal, rigorous and transparent and involves the use of external executive recruitment agencies. This process includes a review of the skills, experience and knowledge of the existing Directors, to assess which of the potential shortlisted candidates would most benefit the balance of the Board having regard also to the need for succession planning.

Accountability — Audit Committee

Chairman

David Adams

Members

David Adams

(Committee Chairman)

Keith Harris

Bill Ronald

Claudia Arney

Meetings

Total Number of Committee meetings: 3

Terms of Reference:

Yes (see website)

"The role of the Audit Committee is key to ensure full stakeholder confidence in the financial matters of the business. It helps to ensure that financial statements are accurate, and that controls, policies and procedures are relevant, up to date and adhered to. This is achieved through regular review, communication with operational and financial management in the business, through the internal audit function, and reviews with the external Auditors."

All the members of the Audit Committee are independent Non-Executive Directors. David Adams has been the Deputy Chief Executive and Finance Director of the House of Fraser Plc and as such is also considered by the Board to have recent and relevant financial experience. Each of the other independent Non-Executive Directors on the Audit Committee has, through their other business activities, significant experience in financial matters. The Chairman, senior members of management and advisors are invited to attend meetings as appropriate.

Time Spent on Audit Committee Business

| Delegated Remit — approval of | Key Considerations throughout the Period |

| Terms of Reference |

Suitability for the Audit Committee to deliver accountability. |

| Half-year report and interim results |

Reflective of the financial situation of the Group. |

| Significant accounting and treasury policies/practices |

Appropriate for the nature of the Group's business. |

| External Auditors |

Continued appointment, remuneration including audit and non-audit work, independence and objectivity. |

| Resolutions and corresponding documents to shareholders at general meeting including annual report |

Ensuring that shareholders have the appropriate information to make informed decisions. |

| Internal audit |

Approval of head of internal audit function. Internal control and risk management statement within annual report. |

| External audit |

External audit report, year end audit strategy and plan. |

| Other Business |

Security processes and store assurance. |

The Audit Committee meets according to the requirements of the Company's financial calendar. The meetings of the Audit Committee also provide the opportunity for the independent Non-Executive Directors to meet without the Executive Directors present and to raise any issues of concern with the Auditors. There have been three such meetings in the period ended 30 March 2012 and nothing of note was reported.

The Audit Committee is responsible for making recommendations to the Board on the appointment of the Auditors and their remuneration, for reviewing the accounting principles, policies and practices adopted in the preparation of the Interim Report and Annual Report and Financial Statement and reviewing the scope and findings of the audit. The Audit Committee assists the Board in achieving its obligations under the Code in areas of risk management and internal control, focusing particularly on compliance with legal requirements, accounting standards and the Listing Rules, and ensures that an effective system of internal financial and non-financial controls is maintained. The ultimate responsibility for reviewing and approving the Annual Report and Financial Statements remains with the Board.

The Committee will keep under review the Auditors' independence including any non-audit services that are to be provided by the Auditors. The Auditors confirm their independence at least annually. A formal policy exists which ensures that the nature of the advice to be provided could not impair the objectivity of the Auditors' opinion on the Group's Financial Statements. This policy was made more robust throughout the period and only allows the Auditors to be engaged for non-audit services subject to Audit Committee approval being obtained prior to any such appointment. Exceptions to this are the engagement of the Auditors for the half-year review, and internal support services in respect of management's annual internal audit plan.

The Audit Committee has approved a formal whistle-blowing policy whereby staff may, in confidence, disclose issues of concern about possible malpractice or wrongdoings by any of the Group's businesses or any of its employees without fear of reprisal. This includes arrangements to investigate such matters and for appropriate follow-up action.

Accountability — Internal Control and Risk Management

Overall responsibility for the system of internal control, reviewing its effectiveness and ensuring that there is a process to identify, evaluate and manage any significant risks that may affect the achievement of the Group's strategic objectives lies with the Board.

The Board and the Audit Committee have reviewed the effectivenessof the Group's internal control and risk management systems in accordance with the Code for the period ended 30 March 2012, and up to the date of approving the Annual Report and Financial Statements. The internal control and risk management system is designed to manage, rather than eliminate, the risk of failing to achieve business objectives and can provide only reasonable, and not absolute, assurance against material misstatement or loss.

The internal audit function principally reviews the effectiveness of the controls operating within the business by undertaking an agreed schedule of independent audits each year. The Audit Committee determines the nature and scope of the annual audit programme at the beginning of each calendar year and revises it from time to time according to changing business circumstances and requirements. Whilst directed by Andrew Findlay, the Company's Finance Director, the internal audit function is independent in action and reporting, with a direct line of communication to the Audit Committee Chairman. The findings of the independent audits are reported initially to Executive management and any necessary corrective actions are agreed. Summaries of these reports are presented to, and discussed with, the Audit Committee along with details of progress against action plans as appropriate.

Currently, the Company has engaged KPMG to support the internal audit process. The plan and scope of work for the future is determined by the Halfords Group Executive management team and the Audit Committee. KPMG act as a resource to allow managerial access to appropriately skilled individuals. KPMG do not perform a management role. It is the intention of the Company to move towards a greater internal resourcing of the Internal Audit function, and recruitment is under way for a suitable qualified Head of Internal Audit, who will build a team to carry out this work.

The assessment and control of risk are considered by the Board to be fundamental to achieving corporate objectives. An ongoing process for identifying and evaluating the significant risks faced by the Group and the effectiveness of related controls has been established by the Board to ensure an acceptable risk/reward profile across the Group. The key elements of this process are:

- a comprehensive system of monthly reporting from key Executives, identifying performance against budget, analysis of variances, major business issues, key performance indicators and regular forecasting;

- well-defined policies governing appraisal and approval of capital expenditure and treasury operations;

- reviews of key business risks and of management's controls and plans to mitigate these risks; and

- an annual corporate governance confirmation made to the Board by all senior Executives on the effectiveness of the identification of major risks and of the monitoring of internal controls within their areas of responsibility.

As part of this process, the Board has established a Risk Management Group to oversee the implementation of the risk management framework, co-ordinate risk management activities throughout the business, and to report to the Board and Audit Committee on risk issues. The Risk Management Group is chaired by the Company Secretary and includes senior managers from Store Operations, Business Systems, Health & Safety, Human Resources, Finance, Store Assurance, Business Services, Multi-channel, Logistics, and Supply Chain functions. During the financial period to 30 March 2012 and up to the date of this report the Risk Management Group considered the Company's Risk Register and its alignment with the Company's key strategic objectives, reporting the findings to the Board. The Board considered its appetite for risk in relation to the top 25 risks determining that the risks and mitigating actions were appropriate to the level of risk that was both acceptable to, and incumbent within, a FTSE 250 business. Read more information on the Company's key risks and uncertainties.

Remuneration — Remuneration Committee

Chairman

Keith Harris

Members

Keith Harris

(Committee Chairman)

Dennis Millard

Bill Ronald

Claudia Arney

David Adams

Meetings

Total Number of Committee meetings: 5

Terms of Reference:

Yes (see website)

"Remuneration of the directors and senior management of a business should be clearly linked to the performance of the company and the value generated for shareholders. The Remuneration Committee upholds this principle by regularly reviewing the remuneration policy and practices of the business to ensure that the appropriate balance is maintained."

All members of the Remuneration Committee are considered to be independent Non-Executive Directors. Executive Directors attend Remuneration Committee meetings at the invitation of the Committee Chairman.

Time Spent on Remuneration Committee Business

| Delegated Remit — recommendations to the Board or for approval by the Committee | Key Considerations throughout the Period |

| Terms of Reference |

Appropriate for the Remuneration Committee to function effectively in establishing remuneration policy and levels. |

| Remuneration policy |

Bonuses for FY11 and FY12. Senior managers' salaries. Future Company-wide bonus opportunities. |

| Awards under the Company's employee and executive share plans |

Consideration of potential awards. Performance conditions. |

| Other business |

Presentations on current trends within Executive remuneration and the use of non-financial KPIs. Remuneration benchmarking presentation by the Hay Group. Remuneration advisors' independence. |

The Remuneration Committee has responsibility for making recommendations to the Board on the Company's policy on remuneration of Executive Directors, the Company Secretary and members of its Executive management team.

The Committee determines, within agreed Terms of Reference, specific remuneration packages for each of the Chairman, the Executive Directors and Company Secretary of the Company and such members of senior management as it is delegated to consider. This includes pension rights; any compensation payments; and the implementation of executive incentive schemes. In accordance with the Committee's Terms of Reference, no Director may participate in discussions relating to their own terms and conditions of service or remuneration.

Further information on the activities of the Remuneration Committee is set out in the Directors' Remuneration Report. A resolution to approve the Directors' Remuneration Report will be proposed at the forthcoming AGM.

Relations with Shareholders

During the period ended 30 March 2012 Bill Ronald served as the Company's Senior Independent Director. The Senior Independent Director is available to meet shareholders upon request if they have concerns that contact through the normal channels of the Chairman or the Executive Directors has failed to resolve, or for which such contact is inappropriate.

The Board recognises the importance of establishing and maintaining good relationships with all of the Company's shareholders and Bill Ronald has indicated his willingness to meet with any shareholders as they request. During the period under review the Chief Executive, Finance Director, Chairman and Remuneration Committee Chairman have met with analysts and institutional shareholders to keep them informed of significant developments and report to the Board accordingly on the views of these stakeholders.

Each of the other Non-Executive Directors is also offered the opportunity to attend meetings with major shareholders and would do so if requested by any major shareholder. The Company's investor relations programme includes formal presentations of full year and interim results and meetings with individual investors as appropriate. Independent feedback from these meetings is provided to the Board. The Company Secretary is also charged with bringing to the attention of the Board any material matters of concern raised by the Company's shareholders, including private investors.

The Interim Report and the Annual Report and Financial Statements are the primary means used by the Board for communicating during the year with all of the Company's shareholders. The Board also recognises the importance of the Internet as a means of communicating widely, quickly and cost-effectively and a Corporate and Investor Relations website is maintained to facilitate communications with shareholders. Information available online includes copies of the full and half-year financial statements, press releases and Company news, corporate governance information and statements and the Terms of Reference for the Audit, Nomination and Remuneration Committees.

The Board is committed to the constructive use of the AGM as a forum to meet with shareholders and to hear their views and answer their questions about the Group and its business. The AGM of the Group is to be held on Tuesday, 31 July 2012 at the Hyatt Regency Birmingham, Bridge Road, Birmingham, B1 2JZ. The Chairmen of the Remuneration, Nomination and Audit Committees will be present at the AGM and will be in a position to answer questions relevant to the work of those Committees. It is the Company's practice to propose separate resolutions on each substantial issue at the AGM. The Chairman will advise shareholders on the proxy voting details at the meeting.

The Company's financial calendar and other shareholder information.

By order of the Board

Alex Henderson

Company Secretary

30 May 2012